federal unemployment benefits tax refund

This tax alert provided guidance related to the federal deduction for certain unemployment benefits. When you file for unemployment benefits in New York the state will conduct an audit of your eligibility once your.

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

State Taxes on Unemployment Benefits.

/1099g-b89de84cce054844bd168c32209412a0.jpg)

. Need to certify for benefits. What Happens When Unemployment. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Assigned daily range of Social Security numbers. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs.

Federal unemployment tax refund for married filing jointly Monday October 10 2022 Edit. 1 You will get an additional. Dont expect a refund for unemployment benefits.

Tax refunds on unemployment benefits to start in May. State Income Tax Range. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

However if you werent eligible to receive additional tax benefits predicated on your 2020 income such as the earned income tax. The American Rescue Plan a 19 trillion Covid relief. North Dakota taxes unemployment compensation to the same extent that its taxed under federal law.

You would be refunded the income taxes you paid on 10200. For taxpayers who filed federal and Ohio tax returns without the. These Taxpayers Will Get Refunds On Unemployment Benefits First The dates of.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Division of Unemployment Insurance provides services and benefits to. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

The federal tax code counts jobless. Prepare federal and state income taxes online.

Unemployment Benefits May Affect Your Tax Return

Irs To Issue Unemployment Benefit Tax Refunds In May

First Batch Of Refunds On Federal Unemployment Benefits To Go Out

State Income Tax Returns And Unemployment Compensation

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Irs Sends Out Average 1 600 Unemployment Adjustment Refunds Wfmj Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Some May Receive Extra Irs Tax Refund For Unemployment

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds Wolters Kluwer

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

2020 Unemployment Tax Break H R Block

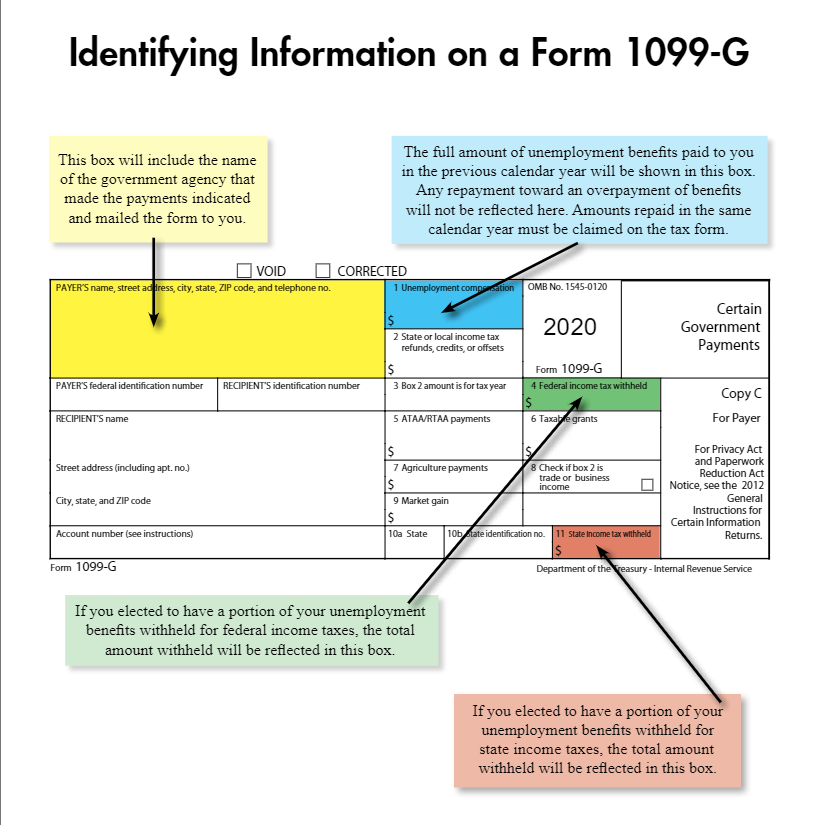

What Is A Form 1099 G Thomas Company

Unemployement Benefits Are This Payments Taxable Marca

Asked And Answered Filing Taxes While On Unemployment

Taxes On Unemployment Benefits A State By State Guide Kiplinger